In the world of real estate investment, property owners have the option to choose between long-term and short-term rentals. Both options have their own set of advantages and challenges. Understanding the main differences between these two types of rentals is crucial in making an informed decision. This comprehensive guide explores the pros and cons of long-term and short-term rentals, giving property owners a deeper understanding of each option.

Long-term vs. short-term rentals

Long-term rentals typically refer to leases that last for a year or more and involve signing a lease agreement, while short-term rentals are for shorter periods, often ranging from a few days to a few weeks. Note that in some areas, short-term rentals are legally defined as properties leased for under 30 days.

Long-term rentals provide stability for both the landlord and the tenant, as they have a long-term commitment to each other. It is common for long-term rental agreements to include clauses regarding rent increases, maintenance responsibilities, and the duration of the lease.

On the other hand, short-term rentals are often associated with second homes or vacation home properties. Travelers and tourists book these listings by the night or week on sites like Airbnb, Vrbo, Booking.com, or direct booking sites. These rentals offer flexibility and convenience for both the property owner and the guests. They allow property owners to generate income during periods outside of personal occupancy, and they offer travelers a home-like experience while they explore new destinations.

Short-term rentals are particularly popular in tourist destinations, as they offer an alternative to traditional hotels, including unique accommodations such as swanky vacation homes, accessible apartments, and even distinctive properties like treehouses. They cater to different types of travelers, including families, couples, and solo adventurers, who are looking for a more personalized and immersive travel experience.

Other key similarities and differences

Now that we understand the primary differences between long-term rental properties and short-term vacation rentals, let’s explore the similar and different benefits and responsibilities for each.

Common short-term and long-term rental property benefits

-Rental expenses can have income tax deduction benefits

-Both have property tax write off potential

-Both require maintenance, albeit different kinds

-Due diligence is required for both, but in different ways

-Both have rental income potential

What’s involved in running short-term vacation rentals

Whether you’re a property owner looking to maximize your income or someone interested in starting a vacation rental management company, running short-term vacation rentals can be an exciting and profitable venture. While there are many benefits to operating short-term rentals, it is an active business and requires daily involvement.

Short-term vacation rental benefits

Let’s dig into some of the benefits of investing in short-term vacation rentals.

More income potential

One of the biggest advantages of short-term vacation rentals is the potential for higher income. Unlike long-term rentals, where rent amounts are typically fixed for the duration of the lease, short-term rentals allow property owners to adjust rental rates based on demand. During peak seasons or special events, property owners can charge higher rates, leading to increased income.

If your investment property has the amenities guests are seeking, and you can master marketing for reservations on Airbnb, Vrbo, and even through your own website, you can earn anywhere from 3-4 times the cash flow you’d get from a long-term rental. The short-term rental strategy is all about optimizing nightly rates versus occupancy.

For example, imagine owning a beautiful beachfront vacation home in a location that attracts tourists from all over the world. During those peak summer months, when the sun shines bright and the skies boast blue with sparkling waves below, you can charge a nightly rate premium for your rental. This flexibility in pricing allows you to make the most of your property’s value and generate a substantial income.

More properties, more potential income

If you have multiple properties and enjoy the rental business, operating a short-term vacation rental portfolio offers the opportunity to start a vacation rental property management company.

Additionally, you may consider managing properties for other owners and earning a commission on bookings to further increase your income potential. In this case, you’re the go-to for second (or more) homeowners who want to maximize their vacation rental property’s income without the hassle of managing the day-to-day operations. As a vacation rental property management company, you can provide a valuable service by handling everything from marketing and guest communication to delegating cleaning and maintenance. Not only will you earn a commission on bookings, but you’ll also build a reputation as a trusted and reliable partner in the vacation rental industry.

Short-term vacation rental challenges

Income dependent on seasonality

One of the challenges of short-term vacation rentals is that income can be seasonally dependent. Some locations experience high demand during certain times of the year, such as summer or holidays, while demand may dip during off-peak seasons. During peak seasons, you may be fully booked and enjoying a steady stream of income. However, during the off-peak season, you may struggle to attract guests and face a decline in revenue.

Homeowners need to carefully manage their finances to account for these fluctuations in income. It’s important to plan ahead and set aside funds during the high season to cover expenses during the slower months.

Susceptible to changing regulations

Another challenge of short-term vacation rentals is the potential for changing regulations. Many cities and towns have started implementing rules and restrictions on short-term rentals to address concerns such as noise, safety, and the impact on residential neighborhoods. Imagine waking up one day to find out that your city has implemented new regulations that limit the number of days you can rent out your property or require additional permits and inspections. These changes can have a significant impact on your business and require you to adjust your rental practices to comply with the new rules. Staying informed about local regulations and being proactive and prepared to adapt your rental strategies to regulatory changes is crucial to the success of your short-term vacation rental business.

Not all rental properties are suited to be short-term rentals

It’s important to note that not all rental properties are well-suited to be short-term rentals. Properties located in areas with limited tourist attractions or lacking amenities may struggle to attract guests. It’s important to carefully consider the location and appeal of your property before venturing into the business.

For example, say you own a cabin in a farmland area far removed from popular tourist destinations. While the property may be beautiful and offer peace and quiet, it may not be in high demand for short-term rental properties. On the flip side, properties like that may be in high demand by locals who need single-family housing. In this case it would be easy to get long-term renters. It’s important to research the market and assess the potential demand for your property before investing time and resources into turning it into a short-term rental.

Requires a diverse set of skills

From marketing, guest communications, cleaning, and maintenance, running short-term vacation rentals requires a diverse set of skills. It can be time-consuming and demanding, especially for those who are not accustomed to the hospitality industry.

From creating compelling property listings to responding promptly to guest inquiries, every aspect of managing a short-term vacation rental requires attention to detail and exceptional customer service. Additionally, ensuring that your property is clean and well-maintained is essential to providing a positive experience for your guests. If you’re considering venturing into the world of short-term vacation rentals, be prepared to wear multiple hats—or delegate as needed—and be proactive in developing the necessary skills.

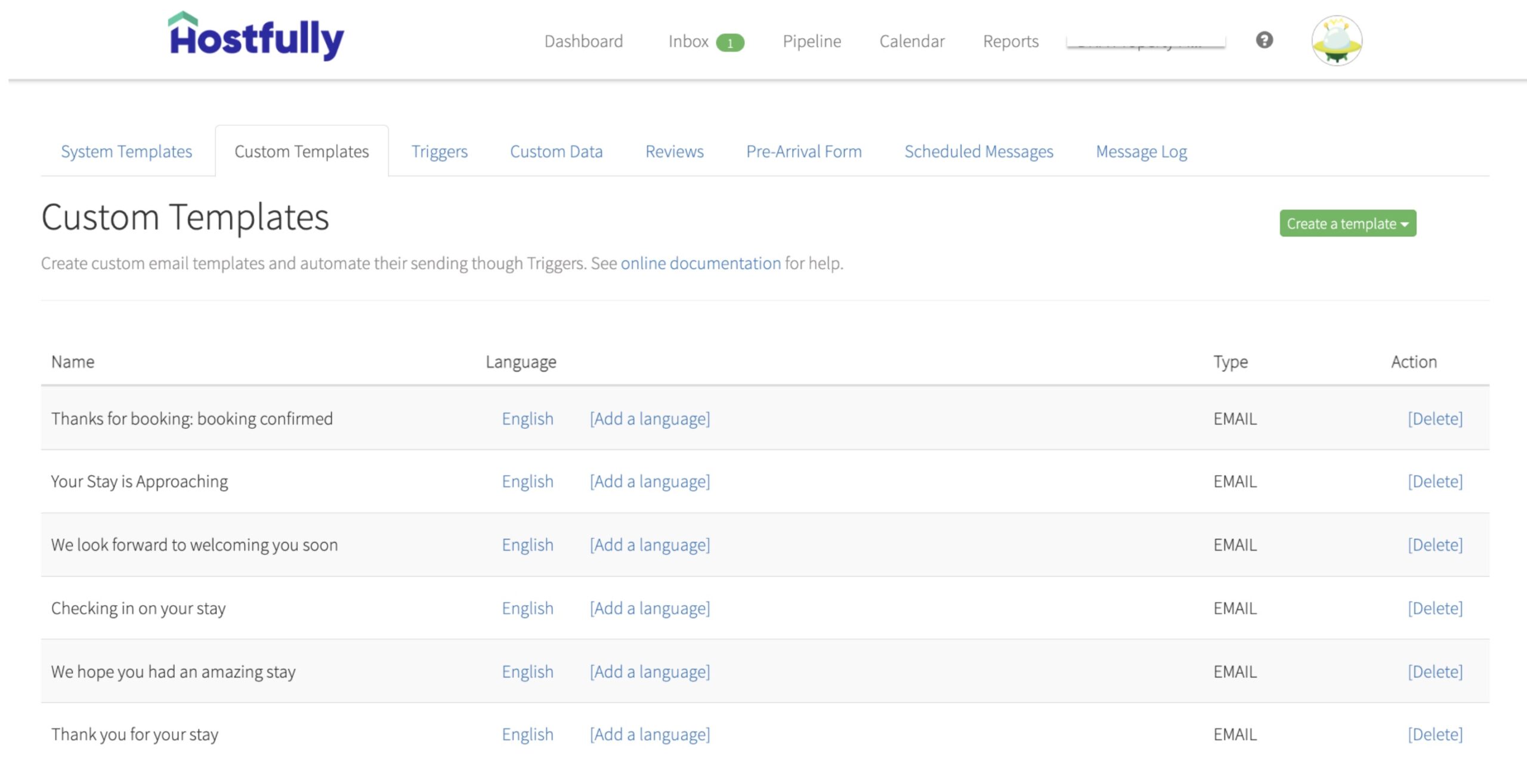

However, property management doesn’t have to be time-consuming. Using a property management system like Hostfully you can automate many time-consuming processes, reduce overhead costs, and secure more 5-star reviews from your guests. Using automation in Hostfully’s PMP eliminates repetitive tasks and reduces mistakes with easy-to-create rules. You can streamline your most time-consuming tasks and use pre-written templates to ensure prompt and efficient guest communication. Additionally, you can connect with third-party short-term rental software to delegate tasks such as cleaning and pricing.

It can be a grind

While you can potentially outsource some of the labor required for your short-term rental business, any manager you should be aware of several factors that are simply unavoidable. Short-term vacation rental businesses often come with a lot of churn. The grind can be intense—and you may feel the property management fatigue. However challenging, it’s critical to stay motivated and—as the name suggests—hospitable. After all, your ratings and reputation rely on it.

Competitive markets and unforeseen conditions

While short-term vacation rentals can be in high demand and an incredibly profitable investment, saturated markets can create competition. You may find that you need to adjust your rental strategy and optimize for thin profit margins at scale in order to make a living. Additionally, shifting seasonal conditions, economic factors, unforeseen events, and global pandemics may leave you vulnerable to potential losses. Again, it’s important to hope for the best, but plan for the worst so that no matter the market, you can handle or adjust as needed.

Exploring the world of long-term rentals

When it comes to real estate investing, long-term rentals are a popular choice for property owners as they offer a steady source of income. Of course, they also come with their own set of advantages and challenges that every investor should consider.

Advantages of long-term rentals

Let’s take a closer look at some of the advantages that long-term rental homes can offer.

Consistent income (with tenant occupancy)

One of the main advantages of long-term rentals is the prospect of consistent income. With long-term leases, property owners have the reassurance of reliable monthly rent payment as long as the tenants stay in the property. This stability can be beneficial for financial planning and provide a steady source of income.

The peace of mind that comes with knowing that your property is occupied and generating rental income month after month is appealing to many. This consistent cash flow allows owners to plan for future expenses, invest in other properties, or simply enjoy the financial security that comes with a reliable income stream.

You can get close to passive income

That reliable cash flow also means you’re closing in on earning a passive income. In other words, the profits your long-term rental property makes is substantial to the amount of time, resources and upkeep it costs you. The less you’re required to do or invest, the more passive your rental income becomes.

Lenders understand long-term rental loans

Obtaining financing for long-term rental properties is typically easier compared to short-term vacation rentals. Traditional lenders are more familiar with long-term rental investments and may offer favorable loan terms for owners looking to purchase or refinance these types of properties.

When it comes to securing a loan for a long-term rental property, real estate owners often find themselves in an advantageous position. Lenders understand the long-term rental market and are more willing to provide financing options that cater to the unique needs of property owners. This may make the process of acquiring a loan smoother and more straightforward.

No need to furnish the properties

Unlike short-term vacation rentals, long-term rentals do not require the property owner to furnish the units. Tenants typically bring their own furniture and belongings, reducing the initial investment and ongoing maintenance costs for property owners.

Not having to worry about furnishing the property can be a significant advantage as it eliminates the need to spend money on furniture, appliances, and other essentials that are typically required for short-term rentals. This not only saves money but also reduces the time and effort required to manage the property.

Long-term vacation rental challenges

While long-term investment properties offer several advantages, they also come with their fair share of challenges that homeowners may need to heed.

Regulations tend to favor renters over landlords

Dealing with difficult renters can be a headache for property owners. Chances are, you’ll eventually find yourself with a problematic tenant. Not only does securing new tenants take valuable time and effort, but there can be a bigger hurdle: one of the challenges in long-term rentals is that real estate regulations often lean towards protecting tenants rather than landlords. So when it comes to problem tenants, evictions can be a time-consuming and costly legal process. Landlords need to carefully follow legal procedures to avoid potential litigation.

From late rent payments to property damage, landlords often find themselves navigating a complex legal landscape to protect their rights. It is crucial for owners to familiarize themselves with standard lease agreements and local laws, and seek legal advice to ensure they are following the correct procedures.

Properties are more susceptible to damage

Long-term rentals may be subject to more wear and tear compared to short-term rentals. With tenants living in the property for extended periods, there is a higher likelihood of property damage that may require repairs and maintenance. Property owners need to account for these potential costs when budgeting for long-term rentals.

While long-term tenants can provide stability, they can also cause more wear and tear on your investment property. From minor repairs to major renovations, homeowners must be prepared to handle the maintenance and upkeep required to keep the property in good condition. This includes setting aside funds for unexpected repairs and conducting regular inspections to identify any potential issues before they escalate.

More difficult to generate positive cash flow

Generating positive cash flow with long-term rentals can be challenging, especially if rental rates do not keep up with increasing expenses. Property owners need to carefully analyze the market and set rental rates that allow for a sustainable income after considering expenses such as property taxes, insurance, and maintenance.

While long-term rentals offer stability, they may not always provide the same level of profitability as short-term vacation rentals. Property owners must carefully consider the rental rates in their area and ensure they are charging enough to cover all expenses and generate a positive cash flow. This requires thorough market research and financial analysis to strike the right balance between affordability for tenants and profitability for property owners.

Limited personal use

Finally, if you own a vacation home and have any interest in using it yourself, long-term rentals are prohibitive. After all, you can’t just boot a tenant out. While some lease agreements are month-to-month, a leading benefit of long-term rentals for property owners is the reliability of trustworthy tenants. So if you think you may want or need occupancy for yourself, family, or friends, you may want to hold off from locking yourself into a long-term rental situation.

Conclusion

By understanding the pros and cons of short-term and long-term real estate rentals, you can build an investment strategy that aligns with your goals and risk tolerance. Whether opting for the potentially higher incomes that can come from short-term vacation rentals, or the stability of long-term rentals, as a rental owner you’ll discover unique challenges and opportunities. Making informed rental property decisions is ultimately the key to success.