Damages can chip away at your profits. The financial success of your Vrbo business often comes down to how well you can protect your properties against spills, breaks, and missing items.

That’s why having a strategy to prevent damage and deal with accidents is a smart move. You spend less on repairs, ensure properties remain in good condition for guests, and keep any owners you work with happy.

Vrbo offers a range of damage protection to cater to different businesses. The trick is to understand which options are available and how to make the most of them.

Our guide breaks down the various Vrbo damage protection features, explains how each one works, and shares tips on how to use them. We also offer advice on how to prevent damage in the first place, to thoroughly minimize the risk to your company.

What is Vrbo damage protection?

Vrbo damage protection refers to the platform’s features that help you recover the cost of guest-related damages. There are several optional features to choose from:

- Insurance

- Damage deposits

- Cards on file

Vrbo launched these features to reduce the friction between hosts and guests. The idea is that its team mediates the claims process when accidental damages have occurred to avoid disputes.

Note that Vrbo damage protection only applies to reservations made through the platform. You must use other listing sites’ built-in policies or specialist vacation rental insurance for anything booked off-site.

Types of Vrbo damage protection

Vrbo offers a choice of damage protection. You must choose one for each listing at a time because the platform doesn’t let you mix and match.

Here’s a closer look at each type:

Vrbo insurance

Accidental damage protection is insurance for guests arranged by Vrbo through a third-party called Generali Global Assistance. You can make it mandatory for users to buy a plan before making a reservation at your listing.

There are three tiers:

- $59 for $1500 coverage

- $89 for $3000 coverage

- $119 for $5000 coverage

Founder and CEO of Red Awning, Tim Choate, says this insurance gives peace of mind to both sides. “It enables you to indemnify minor claims without a fight and maintain goodwill. In the hospitality industry, perception is protection, and guest-paid coverage comes off as professional, not punitive.”

Vrbo damage deposit

Vrbo lets you request refundable security deposits, the most typical way to protect your rental property. You’re free to set the deposit amount. Just don’t go too high because you may deter your guests from booking, especially for short periods.

The amount depends on your property type and amenities. But to give you a ballpark figure, the average damage deposit on Vrbo is between $200 and $500.

Deposits get automatically refunded to guests after 14 days. If you discover any damage to your property after check-out, you must file a claim before that time. Any later and you’re likely to be rejected.

A card on file with Vrbo

Another option is to have Vrbo store a guest’s credit card on file for each booking. Nobody has to pay anything upfront, meaning they might be more inclined to make a reservation if they’re on a tight budget.

This Vrbo feature works similarly to its damage deposits. If you notice any issues with your property, you have 14 days to submit a claim. Vrbo messages the guest and applies the charge to their card on your behalf.

Guests may dispute the charge. In this case, Vrbo will investigate the claim and possibly ask you for photos, cost estimates, receipts, and more.

Why use Vrbo’s damage protection?

You may worry about discouraging potential guests with Vrbo’s damage protection, but it has benefits for both you and them:

- Reduced expenses: If you don’t have insurance or coverage, you must pay out of pocket for any guest-related damages. These expenses add up and significantly cut into your profits over time.

- Clear processes: Vrbo provides a straightforward system for setting, collecting, and refunding security deposits. As everything is self-contained within the platform, this streamlines the process.

- Quick reimbursement: Vrbo typically processes claims within 3-7 business days, giving you a clear timeframe for when you receive funds.

- Less disruption: Using Vrbo damage protection means you spend less time yourself communicating with guests about deposits and possible claims.

- Extra peace of mind: Guests are more likely to treat your property with care when there’s a deposit or card on file. They’re also more likely to understand and take your policy seriously if it’s part of the platform.

- A neutral party to arbitrate: Vrbo acts as an intermediary if there’s a dispute. Once they’ve arbitrated, guests are more likely to trust their decision and stop fighting the verdict.

How to set up damage protection on Vrbo

Adding and editing damage protection on Vrbo is relatively straightforward. Here are the steps you must take:

- Start by logging into your account and selecting the listing you want to update. From the navigation menu, click on “Calendar” and then choose “Settings”.

- Select “Damage Protection” to begin the setup process.

- Choose from the two options: “Property Damage Protection” and “Damage Deposit”.

- If you select “Property Damage Protection”, choose a coverage amount.

- And if you select “Damage Deposit”, simply enter the refundable amount you’d like to require from guests.

- Click “Save” to activate damage protection for your listing.

How to file a damage claim on Vrbo

If damage occurs during a guest’s stay, you need to know how to file a claim quickly to meet the 14-day deadline. Below is a quick step-by-step guide:

- Inspect the property and collect evidence of any damages or lost items.

- Contact the guest to discuss the damage and tell them how much you intend to charge. Vrbo recommends this step to avoid the chances of them misunderstanding and disputing the claim.

- Log in to your Vrbo account and navigate to the relevant listing and reservation.

- Select the guest’s name and click on “Damage Protection” and then “Report Damage”.

- Enter how much you want to collect from the guest — it must not exceed any deposit amounts.

- Write a description of the damage and click “Confirm” to submit.

- Wait 3-7 days to hear back from Vrbo. They will either pay you the deposit amount or investigate the claim further, potentially asking for photos and cost estimates.

Tips for avoiding and minimizing Vrbo property damage

As they say, prevention is better than the cure. Taking as many steps as possible to stop potential damage from happening to your property minimizes costs and preserves your relationship with guests.

Here are some tips you can follow:

Screen guests thoroughly

Run a background check to identify potential issues. Choate says, “We operate auto pre booking filters that highlight high risk patterns: short lead times, local guests reserving large properties, guests with no regular history, etc.” These help you catch people who are likely to throw unauthorized parties or steal things from your rental.

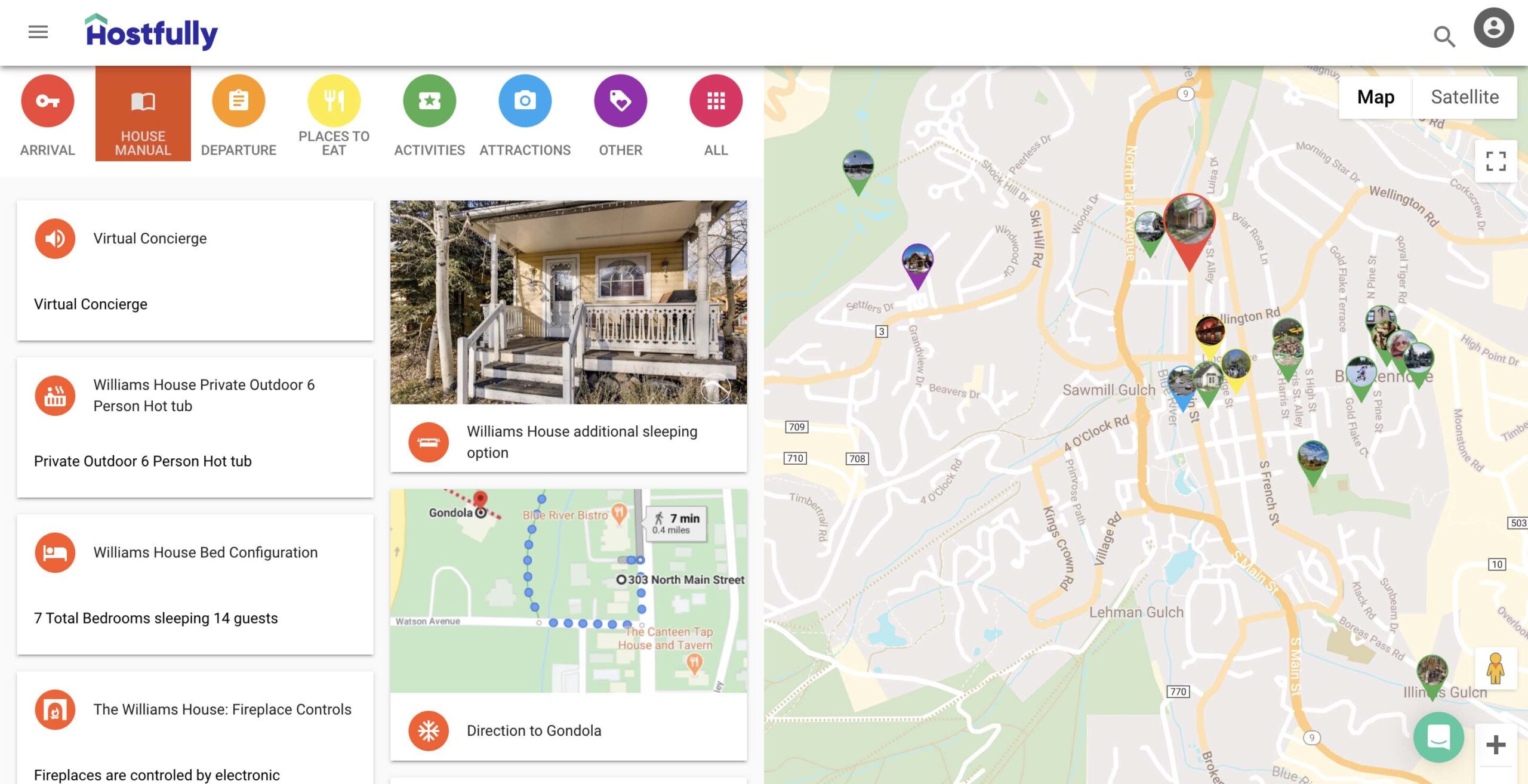

Handling guest checks yourself can be time-consuming. Use screening tools to automatically verify identities and review histories across different countries. These integrate with leading Property Management Systems (PMS) like Hostfully, so you can immediately initiate them once you receive a booking request.

Stay on top of repairs

Furniture and appliances are less likely to break if they’re in good condition. Make sure you address any issues promptly before they escalate.

Turnover management tools can help you stay on top of maintenance from afar. They let you set checklists for staff so they know what to look for during cleaning. To give you more oversight, they also enable you to receive photos of rooms, amenities, and appliances for confirmation.

Ensure house rules are up to date

As Choate says, screening alone isn’t enough. “We’re committed to educating. Our house policies are very clear, and we use friendly but firm communications.”

Adding house rules to your listing helps set expectations. “Guests are more likely to honor what they understand,” says Choate, “And the better organized the experience, the fewer opportunities for disaster.”

Get clearer about your house rules in a digital guidebook. You can explain all your policies and show guests how to follow them. For example, many people break appliances because they’re unclear how to use them, but a simple set of instructions or a how-to video can show them what to do.

Have guests sign a rental agreement

Rental agreements reinforce your expectations and make them clearer to guests. Vrbo lets you add them to the platform (although they defer to the house rules if there are any differences).

PMS like Hostfully allows you to send agreements to guests during the booking process. The software even collects a digital signature to make it official.

Better yet, Hostfully’s unified inbox can automate messages with rental agreements to save you time. All you have to do is write templates and add fields and triggers. When someone makes a booking, our software automatically fills in the right details and sends the email.

Frame insurance and deposits carefully

Be transparent about damage protection, but talk about it as something that helps both you and your guests. Choate says, “If you frame damage protection as ‘a small one-time fee that covers the unexpected so you can relax and enjoy your stay,’ it resonates. But if it’s obscured or presented as a penalty, it risks resistance.”

Choate says this strategy gets Red Awning results. “Our data demonstrates that the more casual we are in talking about protection, the fewer post-booking complaints we get. People willingly accept security when they realize it’s a mutual thing.”

Guests are more likely to tell you about damages as soon as they occur when they feel like you’re working together. They’ll be less worried that you’ll take the full deposit amount. Additionally, they’ll be less likely to try and hide damage, so issues won’t go unnoticed until another guest finds them.

Consider third-party insurance and deposits

Using the Vrbo damage protection features isn’t a host requirement. You’re free to use external insurance companies or set your own refundable damage deposits.

The main difference is that Vrbo won’t take any responsibility or help you arbitrate the process if guests dispute claims. On the one hand, this adds more to your task list. On the other hand, you don’t have to rely on the Vrbo team’s judgment when you’re trying to cover damages.

Most short-term rental insurance providers should integrate with PMS like Hostfully. Finding specialist solutions like these ensures you have the right policies for your business, leaving no gaps in your coverage.

Keep an eye on your rental with smart tech

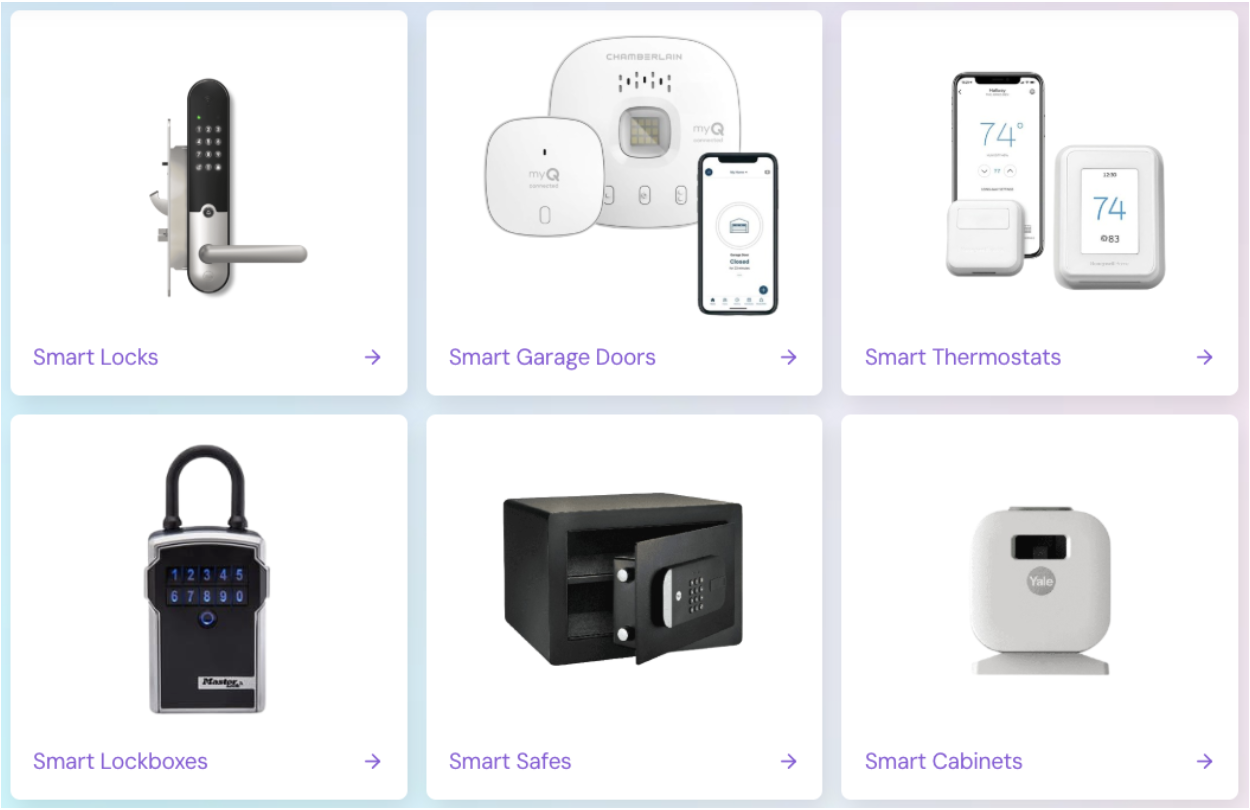

Install smart devices to monitor your property while respecting guests’ privacy. Here are some of the tech that Hostfully offers and what it can do:

- Smart locks: Let guests check in with a code while enabling you to monitor who comes and goes. In particular, you can make sure the property is locked when nobody’s home to reduce the risk of theft.

- Smart lights and thermostats: Guests can control their environment more easily, so they’re less likely to play with settings and break something.

- Noise monitors: Check the volume at the property to see if guests are throwing parties.

- AI concierge: Guests can get all their questions answered, so they understand how to use all your appliances and make the most of your property.

Protect your Vrbo listings the smart way with Hostfully

Vrbo damage protection can give you peace of mind, but it works best when combined with guest screening, clear policies, and proactive property management. Hostfully can help you manage this all in one place.

Our software enables you to:

- Automate guest screening with trusted integration partners

- Collect and track security deposits for every stay

- Sync property details across Vrbo and other booking channels

- Share digital guidebooks that outline house rules and coverage terms

- Coordinate maintenance and cleaning to reduce accidental damage

- Keep guests informed and supported through unified messaging

Hostfully brings together everything you need to safeguard your properties, detect issues early, and support your guests. We reduce the risks to your business so you can move forward and grow with confidence.

FAQs on Vrbo damage protection

Is damage protection mandatory on Vrbo?

No, damage protection is not mandatory on Vrbo. However, you’re strongly encouraged to choose a refundable deposit, guest-paid damage insurance, or request a card on file to protect your vacation rental property.

How much does Vrbo damage protection cost?

Vrbo’s damage protection costs between $59 and $119 per stay for guests. As the host, you decide the policy based on how much coverage you need.

Can I use my own insurance instead of Vrbo’s protection?

Yes, you can use your own insurance instead of Vrbo’s protection. However, note that you can’t combine it with any of the platform’s built-in damage protection features.

Can I use Vrbo’s damage protection and damage deposit?

No, you can’t use Vrbo’s damage protection and damage deposit simultaneously. You must choose one option for each listing, though you’re free to change your type of protection for new reservations.